sacramento property tax rate 2021

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the. Tax Collection Specialists are.

Cryptocurrency Taxes What To Know For 2021 Money

Search For Title Tax Pre-Foreclosure Info Today.

. If you value your property at 200000 and the property tax rate is 81 then the total property tax on the property would be 1620 per year. Sacramento property tax rate 2021. The minimum combined 2021 sales tax rate for sacramento california is.

Sacramento County collects on average 068 of a propertys. 2021-22 1036 104 101036 1 Increase to base year value is limited to 2 percent pursuant to California Constitution article XIII A section 2b. Permits and Taxes facilitates the collection of this fee.

Two Family - 2 Single Family Units. If a tax bill remains unpaid after Oct. Sacramento County collects on average 068 of a propertys.

Two Family - 2 Single Family Units. 31 2021 additional collection costs and monthly penalties at the rate of 15 percent will be added to the base tax. The median property tax on a 32420000 house is 340410 in the United States.

As we stated previously California. Citizens pay roughly 291 of their yearly income on property tax. Sacramento county tax rate area reference by primary tax rate area.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. A delinquency penalty will be charged at the close of the delinquency date. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Sacramento County collects on average 068 of a propertys. Total tax rate Property tax. This tax has existed since 1978.

Sacramento County Finance. View the E-Prop-Tax page for more information. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and.

View the E-Prop-Tax page for more information. Ad Be Your Own Property Detective. The property tax rate in the county is 078.

Emerald hills redwood city 9875. Voter Approved Bond Debt Rates. View Property Appraisals Deeds Structural Details for Any Address in Sacramento.

Please make your Property tax payment by the due date as stated on the tax bill. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

This is the total of state county and city sales tax rates. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Property Tax Administrative Fees - SB 2557.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

Ad Public Sacramento Property Records Can Reveal Mortgages Taxes Liens and Much More.

Foreclosure Rate By Year U S 2021 Statista

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Property Tax In San Diego The Rate When It S Late And Much More

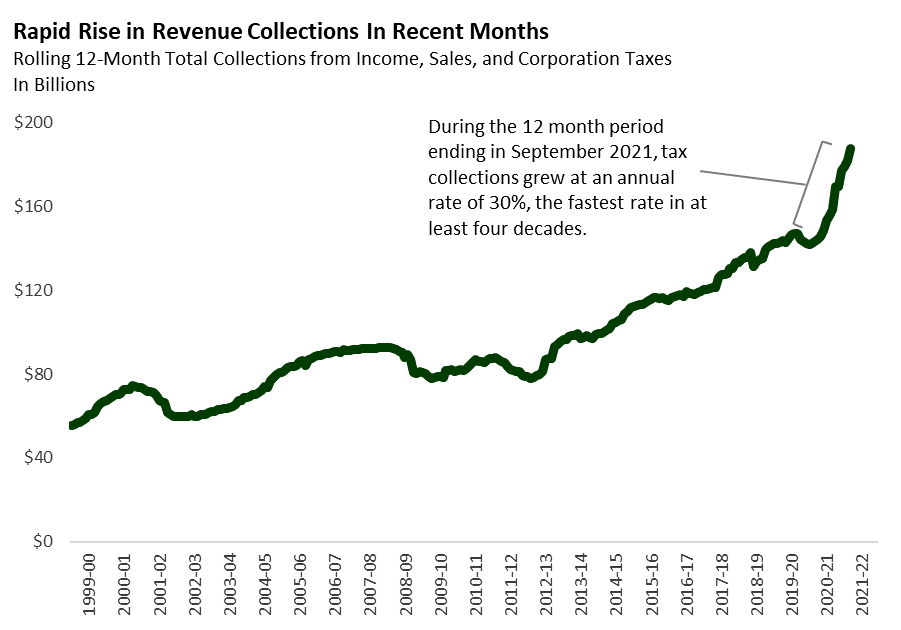

2022 23 Fiscal Outlook Revenue Estimates Econtax Blog

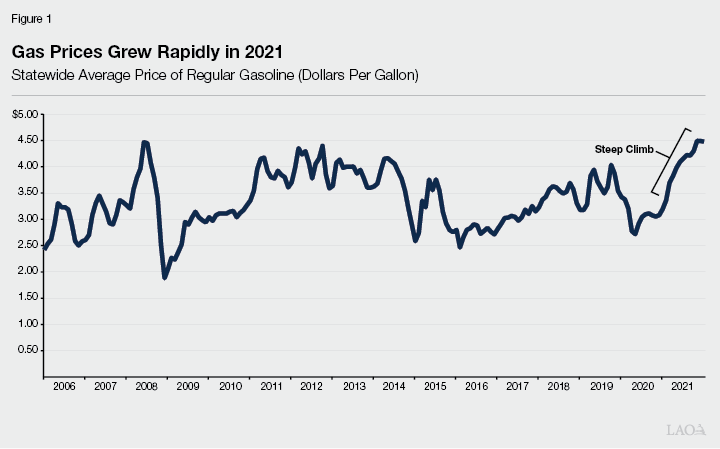

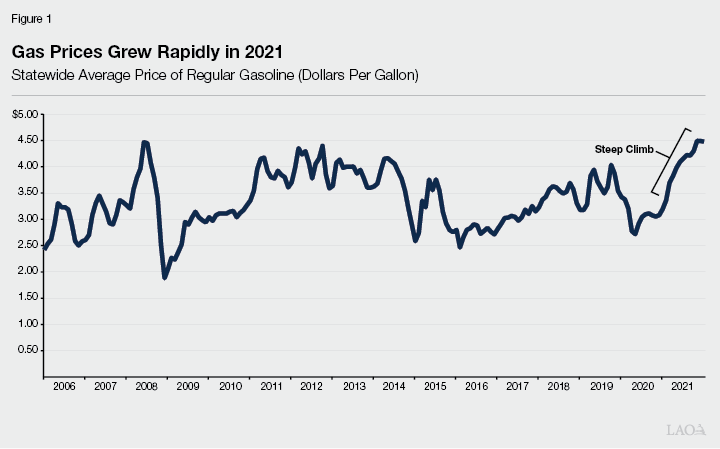

The 2022 23 Budget Fuel Tax Rates

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Secured Property Taxes Treasurer Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

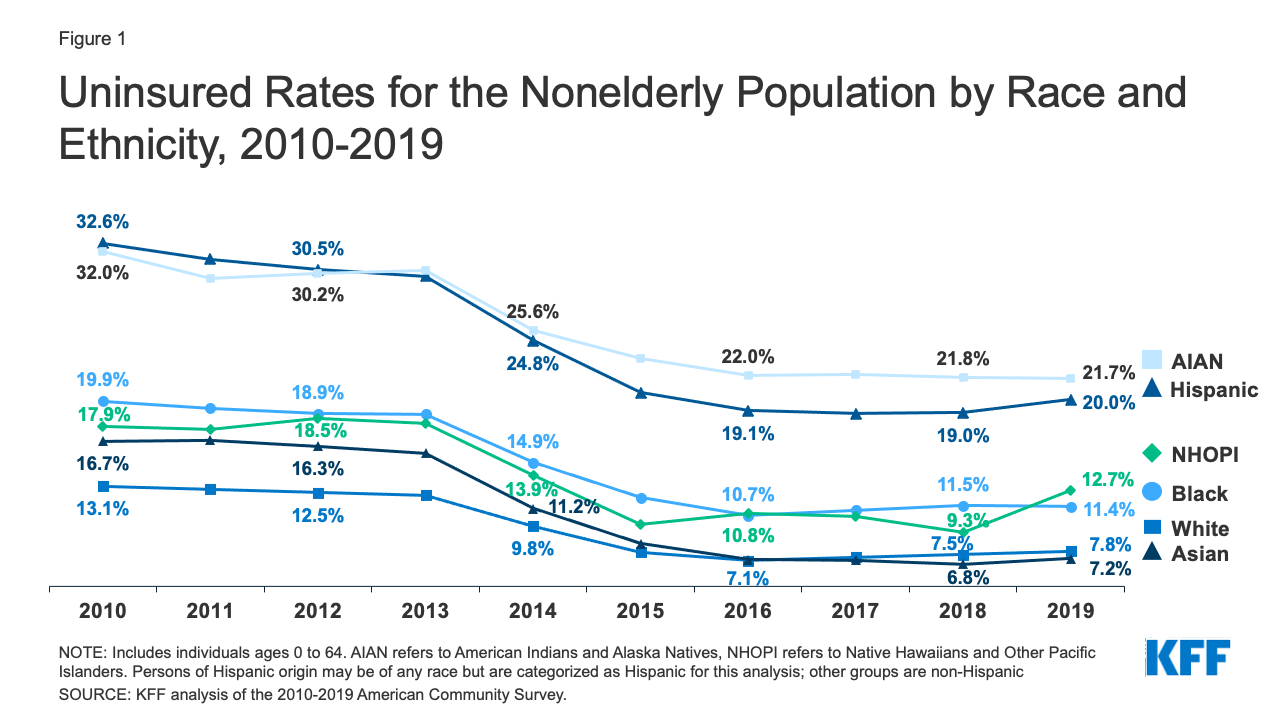

Health Coverage By Race And Ethnicity 2010 2019 Kff

Property Taxes Department Of Tax And Collections County Of Santa Clara

Usps Certified Mail Rates Simple Certified Mail

Secured Property Taxes Treasurer Tax Collector

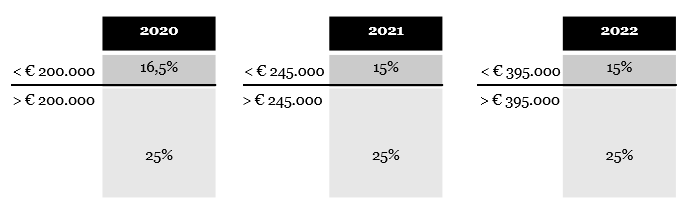

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp